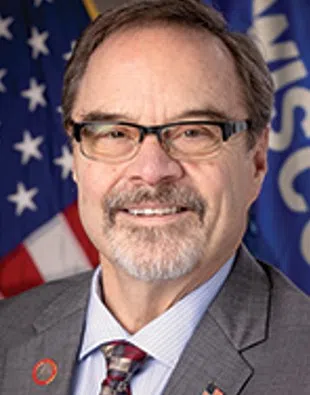

A Wisconsin assemblyman representing Manitowoc and Two Rivers is attempting to reinstate tax cuts he proposed earlier in the budget.

25th District Representative Paul Tittl explained on the WCUB Breakfast Club that it would include the income tax cut for seniors.

The Manitowoc Republican reiterated that seniors are leaving the Badger state for places like Tennessee, Texas, and Florida because they don’t have a tax to withdraw money from their pension.

He would also like to see Wisconsin switch from a progressive tax system to a flat tax, similar to Illinois’s.

“Illinois flat tax, everybody pays the same,” he said. “I don’t care if you make a million or you make $10,000. You’re paying the same. In Wisconsin, you don’t do that. It’s different levels for different amounts of money that you make. So, I’d like to see us get around to the flat tax.”

Tittl also wants to eliminate taxes on residents’ 401 (k) accounts, as other states previously mentioned don’t have a tax on withdrawals.

He also said property taxes continue to hurt seniors as well.

“A pain to live in your own home long after it’s paid for is hurting some very great seniors that maybe retired 20 years ago,” he explained. “And their income has not kept up with the times.”

Tittl says Governor Tony Evers has vetoed a similar bill before and doesn’t believe he will sign a bill creating a flat tax.

If a budget isn’t passed before the June 30th deadline, the state does not shut down; instead, it continues to operate on rates passed in the previous biannual budget.