Taxpayers in Wisconsin have the chance to further wildlife conservation directly on their income tax forms.

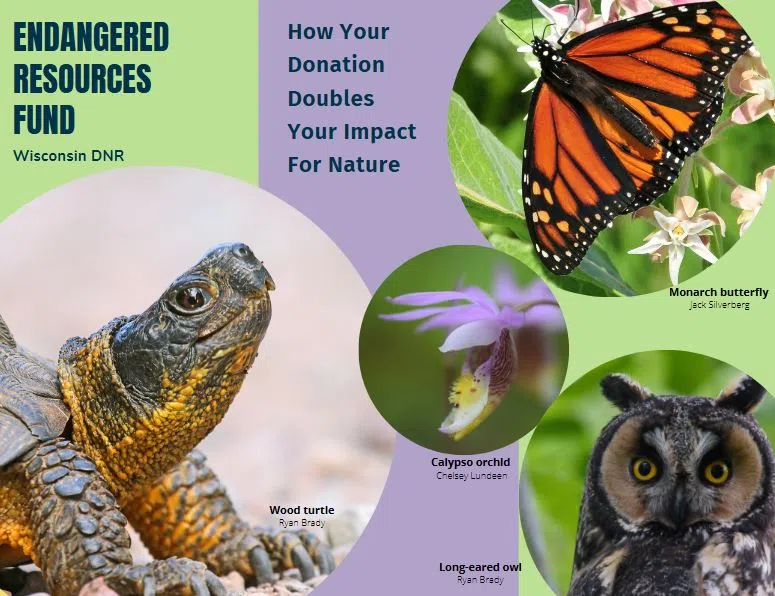

The Wisconsin Department of Natural Resources is reminding Wisconsinites that they are able to donate to the Endangered Resource Fund when filing their taxes which will be fully tax-deductible.

On Wisconsin income tax forms under the donations portion, donations are able to be made to causes such as the Veterans Trust Fund, cancer research, the Special Olympics Wisconsin, and other efforts, including endangered species and habitats.

Taxpayer contributions in the past have helped bring back species such as bald eagles, Blanding’s turtles, and trumpeter swans, and kept many other species from disappearing from the state.

These donations pay for work done by DNR Natural Heritage Conservation staff which conserves State Natural Areas and rare animal species.

For more information on how these tax-deductible donations help Wisconsin’s conservation efforts visit dnr.wisconsin.gov.